Fraud remains a significant challenge for Nigeria’s banking sector, despite improvements in regulations and internal controls. Traditional CCTV has been a staple of bank security for years, but it primarily serves as a post-incident tool, helping only after a fraud has occurred. As fraudulent schemes evolve and internal collusion becomes more sophisticated, banks need surveillance that can identify potential problems before they escalate. This is where AI-powered CCTV comes into play.

Unlike traditional systems that just record, AI-powered CCTV actively analyzes video feeds in real time, recognizing unusual behavior as it happens. For instance, if someone hangs around an ATM too long, tries to access restricted areas, or acts suspiciously near cash centers, AI can send instant alerts. This immediate awareness is crucial for banks, enabling them to stop incidents before they escalate instead of discovering them hours or days later.

Internal fraud poses a particularly significant threat, often involving trusted employees. AI enhances internal security by monitoring behavior in conjunction with digital actions. If an employee accesses sensitive applications, deals with unusually large transactions, or enters secure areas without justification, the AI system can cross-check their physical presence with their digital activity. This makes it difficult for employees to commit fraud without being caught, addressing weaknesses that manual monitoring might overlook.

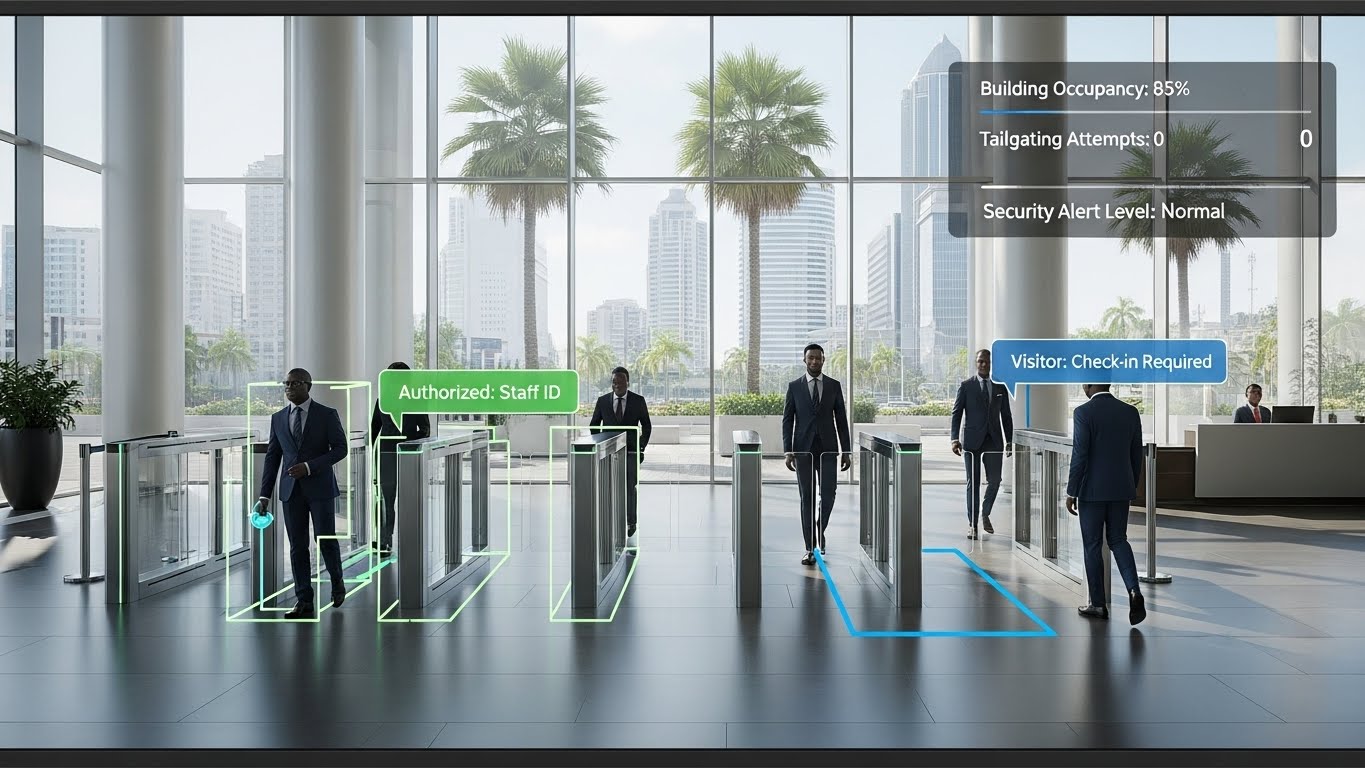

AI-powered CCTV also improves identity verification. By responsibly using facial recognition that adheres to privacy standards, banks can ensure that only authorized personnel gain access to sensitive areas, such as vaults or server rooms. The system can recognize individuals who have been involved in suspicious activities and alert security right away. When integrated with access control systems, it can deny entry, trigger silent alarms, or lock specific doors, helping banks respond to threats in real time.

One of AI’s significant advantages is its ability to learn patterns. Fraud doesn’t always happen suddenly; sometimes it unfolds gradually through repeated actions. AI can notice if an employee frequently visits restricted areas, if someone uses an ATM in a suspicious way, or if movements in the bank deviate from normal behavior. This kind of pattern recognition allows banks to catch fraud early, before deep losses occur.

Additionally, AI streamlines forensic investigations. Instead of sifting through hours of footage, investigators can search for specific faces, objects, timestamps, or actions. The system compiles and organizes relevant video segments automatically, syncing them with transaction logs or access records. Banks employing AI-assisted tools report quicker case resolutions and more reliable documentation for audits and legal proceedings.

AI also extends its protective capabilities to customers. At ATMs, it can detect tampering, card skimming attempts, or any suspicious individuals loitering around customers. Inside banking halls, it can identify tailgating into secure areas or interactions that seem coercive or unusual. Real-time alerts empower staff to intervene right away, reducing the likelihood of successful fraud and preserving customer trust.

To maximize AI’s benefits in Nigerian banks, it must adapt to the local context. Factors like inconsistent lighting, crowded banking halls, and limited infrastructure can affect accuracy. Banks also need to adhere to NDPR guidelines, maintain clear data usage policies, and ensure that surveillance respects the rights of customers and employees. The goal is for AI to enhance human decision-making, not replace it; security teams should still interpret alerts and respond accordingly.

As fraudulent activities become more advanced, banks that rely solely on traditional CCTV will likely fall behind. AI-powered surveillance represents a proactive shift, turning video footage into actionable intelligence that strengthens both physical and digital security measures. With AI, banks can identify threats sooner, conduct investigations more effectively, and significantly mitigate the financial and reputational risks associated with fraud.

Ultimately, AI-powered CCTV isn’t just a technological upgrade; it’s a strategic defense system that prepares Nigerian banks for a more secure future—one where fraud can be anticipated, intercepted, and managed long before it leads to losses.